Analysis

Newport Fuel Solutions: Curing the fuel stability pandemic

A major contributing factor is longer than expected fuel storage times, thanks to the Covid-19 slowdown in bunker deliveries, writes CEO Ralph Lewis.

Published

3 years agoon

By

Admin

The following article ‘Curing the fuel stability pandemic’ has been written by Ralph Lewis, the CEO of refinery-grade fuel treatment additive manufacturer Newport Fuel Solutions, and has been shared with Singapore bunker publication Manifold Times:

A rash of fuel related stoppages and delays have ravaged countless vessels in recent months – most from very predictable issues regarding the stability of IMO mandated 0.5 percent sulfur fuels (VLSFO).

Reports from fuel testing laboratories regarding severe fuel instability of VLSFO-RMG-RMK are unceasing. A continuous series of alerts by the fuel analysis company FOBAS cite instability issues with bunkers from Houston, Singapore, Las Palmas, Rotterdam, and Antwerp, among other areas.

Veritas Petroleum Services (VPS) has also issued numerous alerts, noting that in May 2020 for example, 8.8 percent of samples from European ports were off spec.

This fuel instability pandemic seems concurrent with the global Covid-19 version, and for good reason.

A major contributing factor is longer than expected fuel storage times, thanks to the Covid-19 slowdown in bunker deliveries.

Greatly declining demand for VLSFO-RMG-RMK following the onset of the Covid-19 pandemic resulted in a huge increase in VLSFO-RMG-RMK storage early on. Stored stocks in the Amsterdam/Rotterdam/Antwerp area set a record of 1.74 million mt mid-2020. Singapore storage hit 5 million mt in July 2020. And Fujairah stocks soared mid-year as well.

As VPS explained, ‘Although longer-term storage of marine fuels is possible, it increases the risk of fuel quality issues arising from temperature, stratification, fuel stability….”

This extended storage time especially affects the very particular nature of VLSFO, which has “a lower tolerance to longer term storage and internal stability,” says Naeem Javid, global operations manager of Lloyd’s Register Fuel Oil Bunkering Analysis and Advisory Service.

Of course, many marine fuel treatment companies have opportunistically touted their respective products as the miracle solutions. But not so fast. Overcoming a fuel stability issue with old school sludge dispersant chemistry is not nearly as effective – a situation some vessel operators are discovering with traditional fuel treatment.

The reason? Chemistries that once worked in heavy fuel oil to hold asphaltenes is suspension – preventing their precipitation as sludge – are wholly ineffective in preventing the wave of chemical interactions that occur when two disparate distillate fuels are blended for VLSFO – resulting in rapid fuel quality degradation.

These reactions can begin shortly after the fuel is blended - issues beginning to occur just a matter of days following delivery. Fuel testing of a sample within days of receipt will often be conducted too early for the problem to be detected, as instability reactions are progressive and become much worse over time. For this reason, onboard spot testing for compatibility is often inadequate with VLSFO. Within a few days of bunkering the purification system begins to struggle.

These chemical reactions from fuel bending have been long identified and well understood by petroleum chemists working at the world’s great refineries where fuels are often blended to meet regional demands.

The challenge begins with the fact that fuel chemistry varies greatly in each distillate stream – beginning with the source of the feedstock – the catalysts used for the cracking process – the process method and the variabilities of time and temperature. On any given day at any refinery globally – the chemistry of a particular distillate stream can vary widely regardless of strict control standards. The result? Insoluble are formed when chemically incompatible fuels are mixed.

To quote a Chevron technical description:

“One well established mechanism by which insolubles are formed is the acid-catalyzed conversion of phenalenones and indoles to complex indolyphenalene salts. Phenalenones are formed by oxidation of certain reactive olefins. Indoles occur naturally in certain blends. The required organic acid is either present in a blend component or is generated by the oxidation of mercaptans to sulfonic acids.”

And there are additional factors. The hydrotreatment of fuels to remove sulfur also removes more volatile, higher fractions that contribute to good ignition quality as well as naturally occurring antioxidants. To compensate, refiners typically add a cetane enhancement additive known a 2-ethyl-hexyl-nitrate (2-EHN). Indeed, 2-EHN can boost cetane of an untreated fuel as much as eight numbers when added at a highly aggressive dosage rate.

Yet when these fuels were first introduced in California decades ago, fleet operators with centralized fueling systems began noticing that within days, fuel filter use began to greatly increase. Chevron investigated and discovered that 2-EHN over time decomposed and reacted with certain fuel components to create very high molecular weight structures which not only increased fuel filter plugging but also resulted in deteriorated ignition quality.

These chemical interactions, combined with heat, oxygen and time, form a recipe for fuel Armageddon – destined to turn any healthy purification system into a cauldron of sludge stew.

So, what to do?

Simple. In time, refiners discovered that certain types of amine-based anti-oxidant chemistries were able to completely block the chemical reactions which lead to the formation of insolubles and higher carbon weight molecular structures which were causing excessive fuel system fouling and compromised ignition quality.

Taken a step farther – it was also discovered that these chemistries also blocked the formation of less volatile, high-carbon weight structures which occurred when unsaturated olefinic hydrocarbons would actually join together into unburnable polymeric chains during the combustion process. In other words, it turned out that by blocking this process, thermal stability of the fuel was greatly improved – providing more power per unit of fuel and a reduction in unburned hydrocarbons and emissions.

This is precisely why traditional physical dispersants will predictably fail when a stability problem is the result of chemical reactivity between two fuels. While they may have some limited benefit dispersing some of the material that forms from such reactions – a dispersant will not stop the initial reaction or the progression of a reaction - some of which can be quite rapid and damaging.

THE SOLUTION

Yet there is a cure, time tested to be safe and extraordinarily effective in preventing the fuel stability contagion.

Among Newport Fuel Solutions marine fuel treatment products are two formulas specifically formulated to stop stability issues in marine fuels from the moment two fuels are blended. Both contain 100 percent active chemistries – the same used by refiners globally to address the same issues. And today these products – NP-HFO, and NP-FOT, are on hundreds of vessels, completely preventing slowdowns and stoppages from severely compromised fuel quality.

These chemistries are formulated with refinery-grade amines which block the unwanted chemical reactions which occur following blending. Fuel delivery systems remain clean. Sludge and insoluble precipitation are greatly reduced. Icing on the cake is a marked improvement in thermal stability which provides enhanced ignition quality, inhibition of damaging deposits, and reductions in particulates and unburned hydrocarbons.

Unlike competitive products – Newport does not use any cheap, petroleum “filler” solvents to “water down” the products for greater profitability. The products contain only 100 percent active ingredients – the thinking is that ship owners should enjoy the same low treatment costs as global refiners. With no volatile petroleum solvents – the products are also deemed non-hazardous – safe for personnel to handle – safe to store on board.

Because these are refinery-grade concentrates, treatment cost is far lower than conventional marine fuel additives. With a treatment rate of one liter per 30 mt, NP-FOT is an organic amide/amine product capable of remedying and even reversing fuel stability issues. NP-HFO contains an additional component specifically designed to greatly boost fuel thermal stability – providing better ignition quality for deposit control for VLSFO. NP-HFO is also the choice for vessels with scrubber towers burning conventional RMG380 and RMK 380 fuels.

Since January 2020, vessels treating fuel with either of these products have experienced a 99.2 percent success rate – no fuel system fouling – no stoppages – no charter hire loss - no doubt why Newport products are the choice for many of the world’s greatest fleet operators.

The Author

Ralph Lewis is the CEO at Newport Fuel Solutions, Inc.

Mr. Lewis served as Technology Transfer and Public Information Specialist with Shell Oil and eventually, as Vice President Technical with Power Research Inc for over 32 years.

Contact details:

Phone: +1 832 627 7499

Email: [email protected]

Website: www.newportfuelsolutions.com

Photo credit: Manifold Times

Published: 17 May, 2021

Analysis

JLC China Bunker Market Monthly Report (March 2024)

China’s bonded bunker fuel sales grew in March, as the shipping industry recovered gradually and sellers actively boosted sales on the back of ample supply and high inventories.

Published

1 month agoon

April 11, 2024By

Admin

Beijing-based commodity market information provider JLC Network Technology Co. recently shared its JLC China Bunker monthly report for March 2024 with Manifold Times through an exclusive arrangement:

Bunker Fuel Demand

China’s bonded bunker fuel sales surge in March

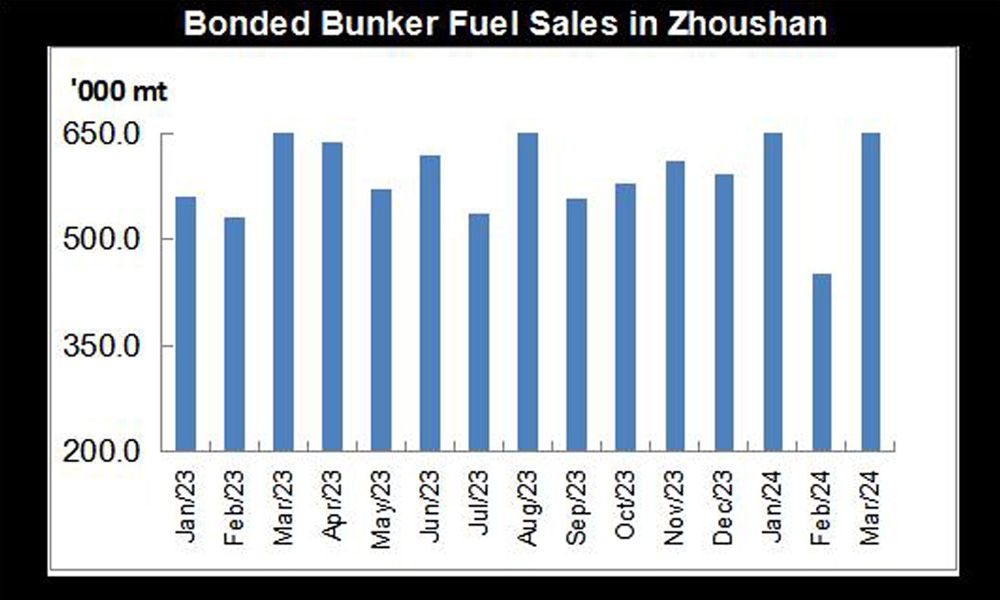

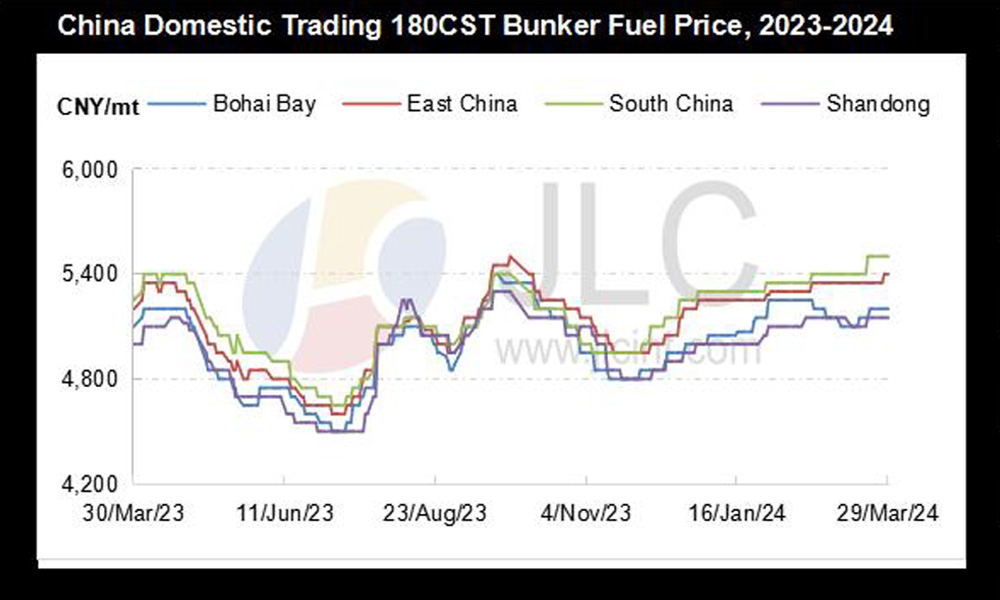

China’s bonded bunker fuel sales grew in March, as the shipping industry recovered gradually and sellers actively boosted sales on the back of ample supply and high inventories. Domestic LSFO prices were lower than those in Singapore and other neighboring ports, incentivizing shipowners or operators to refuel their vessels in China, with bunkering volume in Shanghai and Zhoushan rising considerably.

The country sold about 1.82 million mt of bonded bunker fuel in the month, with the daily sales up 13.59% month on month to 58,658 mt, JLC’s data shows.

Sales by Chimbusco, Sinopec (Zhoushan) and China ChangJiang Bunker (Sinopec) came in at 540,000 mt, 630,000 mt and 30,000 mt in March, while those by suppliers with regional bunkering licenses settled at 558,400 mt. At the same time, SinoBunker sold about 60,000 mt of bonded bunker fuel, the data indicates.

China’s bonded bunker fuel exports rise in first two months

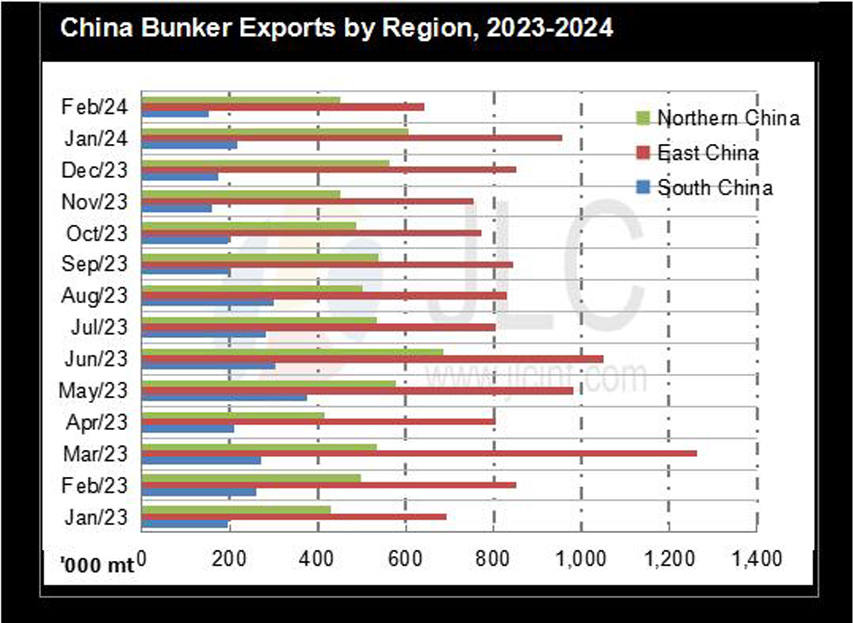

China’s bonded bunker fuel exports rose in the first two months of this year, underpinned by fresh quotas and larger production.

The country exported a combination of 3.02 million mt of bonded bunker fuel in January-February, growing by 3.13% from the same months in 2023, JLC estimated, with reference to data from the General Administration of Customs of the PRC (GACC).

Heavy bunker fuel exports totaled about 2.85 million mt in the two months, accounting for 94.13% of the total, while light bunker fuel exports were 177,500 mt, accounting for 5.87%.

The increase in the exports mainly came as China released this year’s first batch of quotas on LSFO exports at the end of 2023. Though refiners’ LSFO production margins were relatively poor, they ramped up their production amid new quotas, which buoyed the exports. China’s LSFO output totaled 2.57 million mt in January-February, with the daily output gaining 2.69% year on year to 42,850 mt, JLC’s data shows.

In January alone, China’s bonded bunker fuel exports settled at 1.78 million mt, jumping by 11.93% month on month and 34.71% year on year.

However, the exports plunged to 1.25 million mt in February, down by 29.99% month on month and 22.75% year on year. Bunkering business at Chinese ports was halted during the Chinese New Year holiday, and customs’ clearing procedure for export was also affected by the holiday. In addition, the operation of many ports was hit hard by heavy snow and freezing rains, adding to the downward pressure on the exports.

Domestic-trade bunker fuel demand rises in March

Domestic-trade heavy bunker fuel demand recovered mildly in March, as the shipping industry rebounded after the Chinese New Year holiday. However, the demand growth was still limited as some shipowners still suspended services and the market was dominated by wait-and-see sentiment amid high prices.

Domestic-trade heavy bunker fuel demand was estimated at 430,000 mt in the month, a gain of 70,000 mt or 19.44% from a month earlier, JLC’s data shows.

Meanwhile, domestic-trade light bunker fuel demand was estimated at about 140,000 mt, a gain of 20,000 mt or 16.67% from a month earlier, the data indicates.

Bunker Fuel Supply

China’s bonded bunker fuel imports soar in Jan-Feb

China’s bonded bunker fuel imports soared in January-February 2024, due to a low base a year earlier.

The country recorded 581,900 mt of bonded bunker fuel imports in the two months, a surge of 27.36% year on year, with 359,200 mt in January and 222,700 mt in February, JLC estimated, with reference to data from the GACC.

China’s bonded bunker fuel imports dived to a record low in January-February 2023, as bunkering demand had not fully recovered from the epidemic, also because of high freight rates and ample domestic supply. The imports totaled only 456,900 mt in the first two months of 2023, tumbling by 48.01% year on year.

On the other hand, Chinese refiners boosted LSFO production in January-February 2024, limiting the import growth. These refiners produced about 2.57 million mt of LSFO in the two months, with the daily output climbing by 2.69% year on year to 42,850 mt, JLC’s data shows.

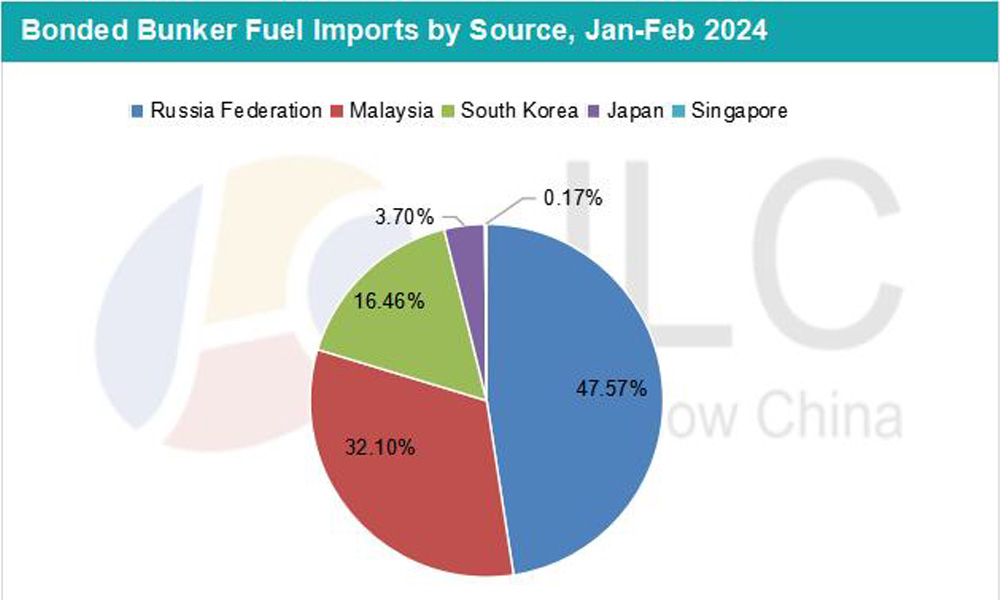

Russia became the largest bonded bunker fuel supplier in the first two months of this year, exporting 276,800 mt to China, accounting for 47.57% of the latter’s total imports. Malaysia ranked second with 186,800 mt, accounting for 32.10%, followed by South Korea with 95,800 mt, accounting for 16.46%. Japan climbed to the fourth place with 21,500 mt, occupying 3.69%, while Singapore slipped to the fifth place with only 1,000 mt, making up 0.17%.

In China’s bonded bunker fuel market, only HSFO and MGO are still mainly imported, while LSFO is rarely imported as its import efficiency is relatively low amid steep freight rates.

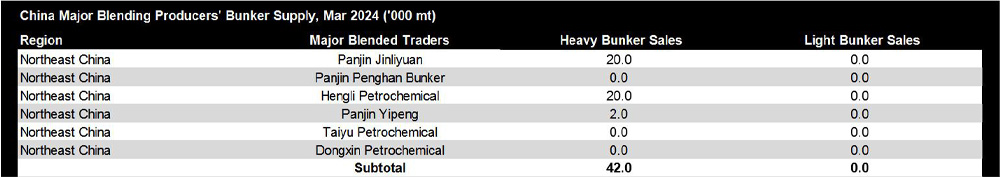

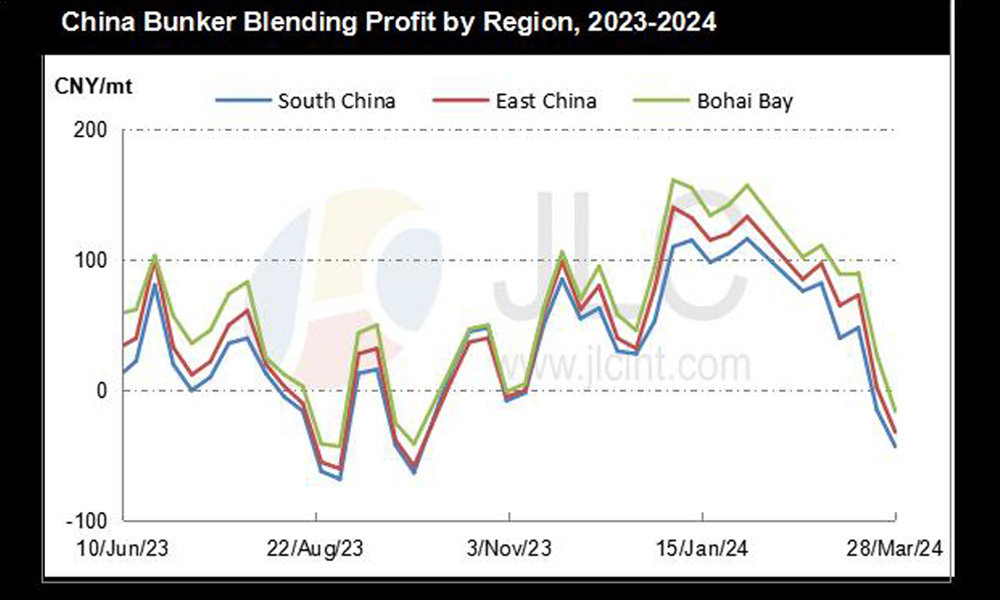

Domestic-trade bunker fuel supply increases in March

Domestic-trade heavy bunker fuel supply improved in March, as availability of some blendstocks (such as low-sulfur residual oil and shale oil) increased.

Chinese blenders supplied about 460,000 mt of domestic-trade heavy bunker fuel in the month, a rise of 60,000 mt or 15% from February, JLC’s data shows.

Similarly, domestic-trade MGO supply rose to 160,000 mt in March, up 30,000 mt or 23.08% month on month, the data shows. Refineries’ enthusiasm for MGO production improved in March, as domestic MGO prices moved up along with domestic oil products.

Editor

Yvette Luo

+86-020-38834382

[email protected]

Sales (Beijing)

Tony Tang

+86-10-84428863

[email protected]

Sales (Singapore)

Ginny Teo

+65-31571254

[email protected]

[email protected]

JLC Network Technology Co., Ltd is recognized as the leading information provider in China. We specialized in providing the transparent, high-value, authoritative market intelligence and professional analysis in commodity market. Our expertise covers oil, gas, coal, chemical, plastic, rubber, fertilizer and metal industry, etc.

JLC China Bunker Fuel Market Monthly Report is published by JLC Network Technology Co., Ltd every month on China bunker market, demand, supply, margin, freight index, forecast and so on. The report provides full-scale & concise insight into China bunker oil market.

All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a computer system or otherwise redistributed without prior authorization from JLC.

Related: JLC China Bunker Fuel Market Monthly Report (February 2024)

Related: JLC China Bunker Market Monthly Report (January 2024)

Note: China-based commodity market information provider JLC Technology has been providing Singapore bunkering publication Manifold Times China bunker volume data since 2020. Data from earlier periods are available here.

Photo credit: JLC Network Technology

Published: 11 April 2024

Fuel Testing

VPS publishes 2023 annual review of its findings on bunker fuels

Findings in VPS’ review include 58% of its 2023 Bunker Alerts were for VLSFO fuels, followed by 24% for MGO fuels and 14% for HSFO; most common problematic parameter was Flash Point.

Published

4 months agoon

January 30, 2024By

Admin

Marine fuels testing company VPS on Tuesday (16 January) published an article titled ‘2023 Marine Bunker Fuels Review’ by Steve Bee, VPS Group Commercial Director, giving insightful annual review of VPS findings on both global and regional maritime fuel matters, focusing on marine fuels.

Introduction

2023 saw the continuing evolution and the widening of available maritime fuel types and grades, as the global shipping industry gathered decarbonisation momentum to reduce its emissions and achieve current and future legislation targets. Existing CII and EEXI requirements, the incoming EU ETS legislation, plus the slightly longer-term IMO legislation, saw increasing demand for additional testing, lower-carbon fuels, data and digitalisation solutions across the shipping sectors.

As the leading maritime decarbonisation testing and advisory services provider, VPS continued to be at the forefront of marine fuels and lubricants analysis, utilising our experience, expertise and innovative approach, to support this drive for a more sustainable shipping fleet.

Throughout the year, VPS witnessed further fuel quality issues with VLSFOs in terms of cold-flow property issues, sulphur compliance and cat-fines. HSFO and VLSFO suffered numerous degrees of chemical contamination, whilst MGO suffered from cold-flow, flash point and FAME off-specifications.

Biofuels usage certainly gathered momentum and the increased demand from the market led to increasing queries regarding their fuel management and their “fit-for-purpose” as a drop-in marine fuel, which in turn called upon VPS to provide answers and solutions to customers, utilising our extensive knowledge and understanding of biofuels and their associated test parameters.

The Marine Fuel Mix

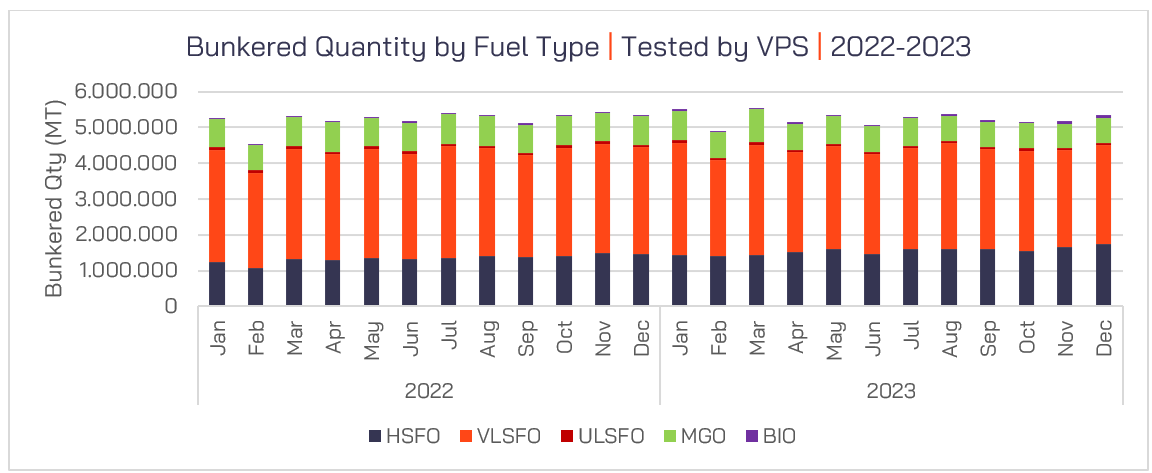

Across 2023, the fuel mix with respect to samples received for testing in VPS laboratories, equated to 62.7 million MT, which is over 5 million MT of marine fuels per month. VLSFO was the most popular marine fuel with 54.3% of the fuels used, followed by 29.5% HSFO (a growth of 15.4% over 2022), 14.2% MGO, 1.2% ULSFO and 0.8% Biofuels. Regarding biofuels usage, the samples tested by VPS equated to an increase from 231,000 MT in 2022 to 558,000 MT in 2023.

VPS Bunker Alerts

Bunker Alerts highlight short term fuel quality issues identified by VPS, for a specific test parameter of a specific fuel grade/type in a specific port. The service provides valuable information to customers, to assist in avoiding potentially problematic fuel types in a highlighted port or region, to further protect the customer’s asset and crew.

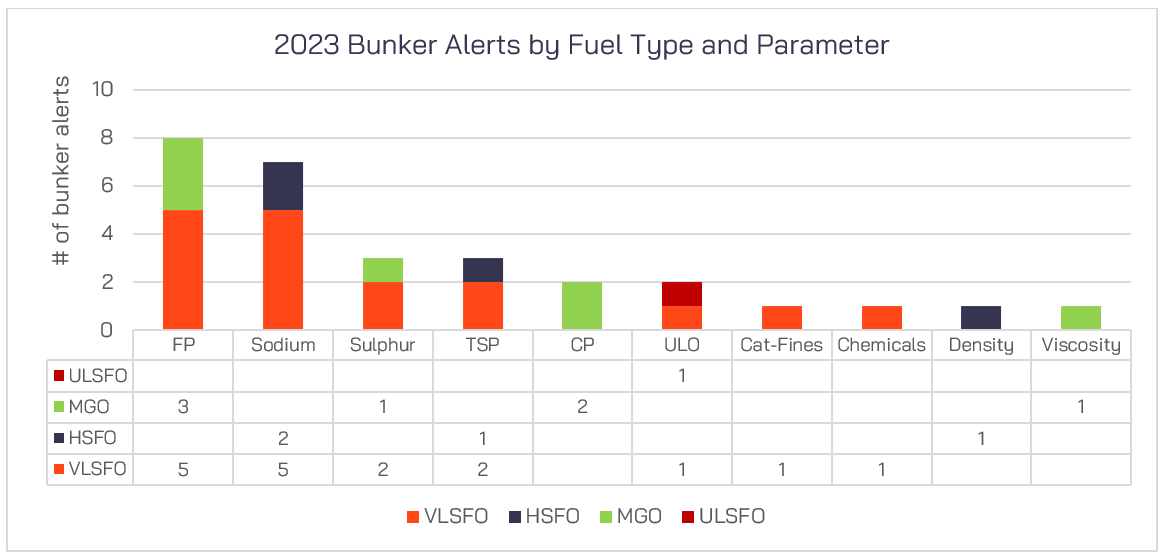

In 2023 VPS issued 28 Bunker Alerts, eight fewer than in 2022. The 2023 Bunker Alerts included all major fuel grades, i.e. VLSFO, HSFO, MGO and ULSFO, ten different test parameters, 12 ports and 9 countries.

58% of the 2023 Bunker Alerts were for VLSFO fuels, followed by 24% for MGO fuels and 14% for HSFO. The most common problematic parameter was Flash Point, accounting for 28% of the Bunker Alerts, followed by Sodium at 24%, with Sulphur and TSP at 10% each.

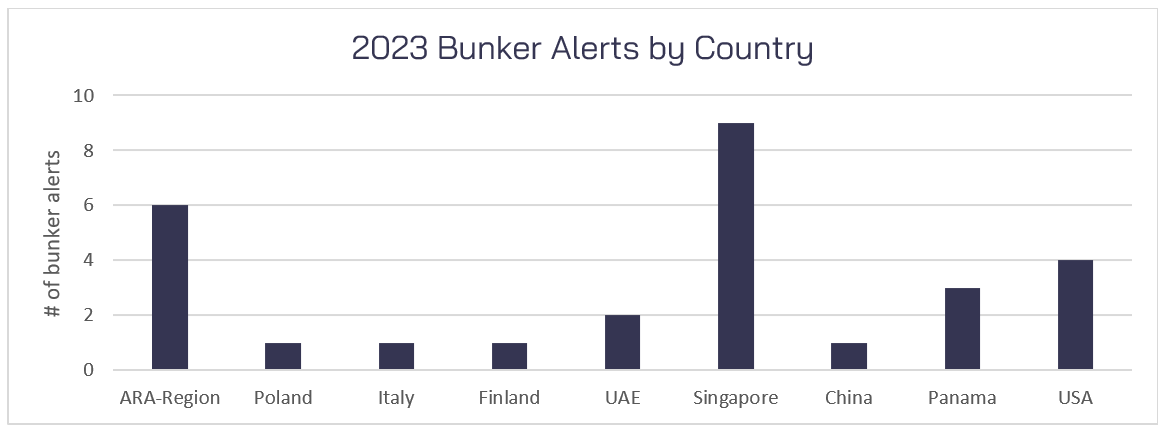

Singapore (32%) and ARA (21%) were the regions/ports most frequently requiring a Bunker Alert to be issued. But as these are the two busiest bunkering regions, it is not too surprising.

VLSFO Fuel Quality

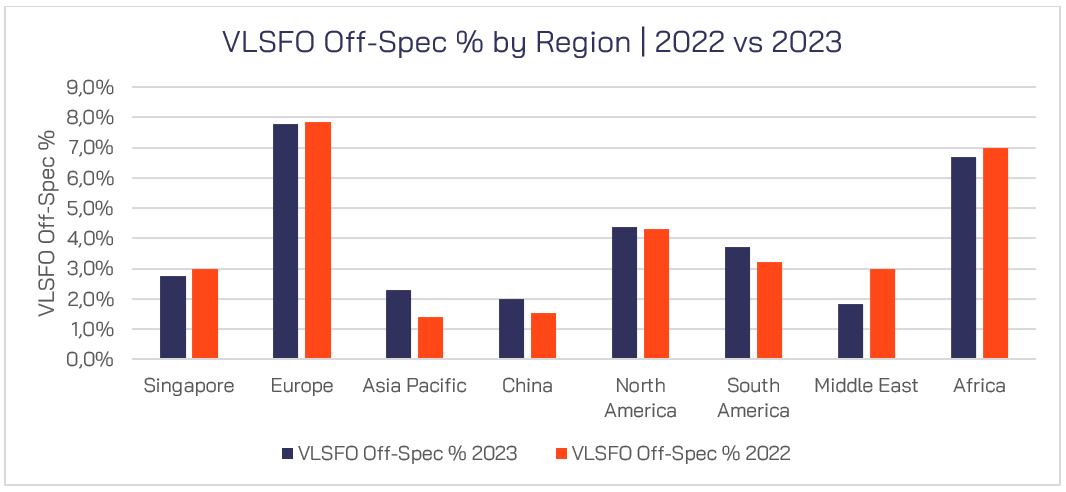

As the most used marine fuel type, VLSFO accounts for more than half of the fuels tested by VPS. In terms of quality, Europe provided the highest level of off-specification VLSFOs in both 2023 (7.8%) and 2022 (7.9%). Africa provided the next highest level of off-specification fuels with 6.7% in 2023 and 7.0% in 2022, with North America third with 4.4% of fuels tested exhibiting at least one off-specification parameter in 2023 and 4.3% in 2022.

Sulphur is the most common off-specification parameter of VLSFOs, accounting for 26.6% of VLSFO off-specs in 2023 and 31.5% in 2022. 0.7% of VLSFOs tested in 2023 had a sulphur level of 0.50%-0.53%, with 0.5% of samples tested having a sulphur level greater than 0.53%.

Pour Point was also a common off-specification parameter for VLSFOs with 13.6% of VLSFOs off-specs relating to this parameter in 2023 an increase over the 11.4% level witnessed in 2022.

The importance of the additional cold-flow test of Wax Appearance Temperature (WAT) and Wax Disappearance Temperature (WDT), was highlighted in 2023 with 63% of VLSFOs exhibiting WAT of 31-40ºC and 14% having WAT between 41-50ºC. 55.7% of VLSFO samples had a WDT of 41-50ºC, with 28.1% having a WDT of >50ºC. VLSFOs cold-flow properties are a definite concern with wax precipitating from the fuel at temperatures way in excess of 10ºC above the pour point, potentially causing numerous operational problems such as filter and pipework blockages.

Sulphur is the most common off-specification parameter of VLSFOs, accounting for 26.6% of VLSFO off-specs in 2023 and 31.5% in 2022. 0.7% of VLSFOs tested in 2023 had a sulphur level of 0.50%-0.53%, with 0.5% of samples tested having a sulphur level greater than 0.53%.

Pour Point was also a common off-specification parameter for VLSFOs with 13.6% of VLSFOs off-specs relating to this parameter in 2023 an increase over the 11.4% level witnessed in 2022.

The importance of the additional cold-flow test of Wax Appearance Temperature (WAT) and Wax Disappearance Temperature (WDT), was highlighted in 2023 with 63% of VLSFOs exhibiting WAT of 31-40ºC and 14% having WAT between 41-50ºC. 55.7% of VLSFO samples had a WDT of 41-50ºC, with 28.1% having a WDT of >50ºC. VLSFOs cold-flow properties are a definite concern with wax precipitating from the fuel at temperatures way in excess of 10ºC above the pour point, potentially causing numerous operational problems such as filter and pipework blockages.

2023 also saw a significant increase in cat-fine levels in VLSFOs, with 12.7% of all off-specifications relating to this parameter, compared to 8.5% in 2022. 16.2% of all VLSFOs showed a cat-fine level greater than 40ppm. Frequent checking of purifier efficiency via VPS’ Fuel System Checks (FSC) service is a highly recommended proactive safeguard in respect to increased cat-fines within VLSFOs.

VLSFO viscosities vary enormously depending upon to blend components used. In 2023 VLSFO viscosities ranged from <20Cst to >380Cst. 16% of all VLSFO off-specifications were due to viscosity. Only 0.5% of VLSFOs had a viscosity of >380Cst. 68% of all VLSFO viscosities were less than 180Cst. Viscosity is such a key operational parameter, determining the transfer and injection temperatures of fuel onboard ships and therefore determining the exact viscosity of VLSFOs is crucial to ensure optimal efficiency.

Biofuels

As global shipping looks towards low-to-zero carbon fuels to answer many emissions reduction challenges, biofuels offer an immediate “drop-in” solution. As such VPS tested the equivalent of over 500,000 MT of biofuels in 2023 compared to ca. 230,000 MT in 2022.

Europe, (mainly ARA-region) provided the highest volume of biofuels at almost 400K MT (ca. 74%) and Singapore second (ca. 21%), providing just over 100K MT.

The most common biofuel blend was B30 (10-30% bio), which accounted for 34.3% of biofuel samples tested by VPS. Yet, B100 (>90% bio) was not far behind with 30.1%.

The majority of biofuels contained Fatty Acid Methyl Esters (FAME) as the bio-component, although VPS did test others containing HVO, HEFA, Cashew Nut Shell Liquid (CNSL) and Tyre Pyrolysis Oil (TPO).

Where FAME is the bio-component within marine biofuels, the key considerations are:

- Energy Content, Renewable Content

- Fuel Stability, Cold-Flow Properties

- Corrosivity, Microbial Growth

Of the biofuels tested by VPS in 2023, 9% of those tested for oxidation stability gave the concerning result of <5 hours, highlighting a high degree of instability, whilst 6.7% gave a result of 5-8 hours which is still a cause for concern.

In terms of corrosivity, 11.9% of those biofuels tested provided an amber/caution result, whilst 8.5% of those tested provide a red warning, indicating potential high levels of corrosivity.

It is fully expected that the growth in biofuels usage for marine applications will continue to increase across 2024 and the VPS Additional Protection Service (APS) when using biofuels, will only increase in importance as the industry looks for more information regarding the fuel management of biofuels.

Summary

2023 once again highlighted the importance of bunker fuel quality testing, as a proactive means to protect vessels, their crew and the environment. With additional tests, currently not included within ISO8217, providing further vital information in achieving heightened levels of protection.

Whilst we can expect a new revision of ISO8217 in early 2024, additional tests will still hold an important role in fuel management.

Biofuels usage will continue to increase in demand and importance, as ship owners and operators look to achieve improvements through CII and EEXI, as well as looking to counter the financial impact of the EU ETS scheme.

Methanol demand and usage will also grow, following the recent success of Maersk’s Laura Maersk and the rapidly growing order book for methanol-powered vessels.

So 2024, suggests another year of widening marine fuel types and grades coming to market, coupled with their growing fuel management considerations.

Note: The full article titled ‘2023 Marine Bunker Fuels Review’ with related graphs and charts can be found here.

Related: World’s first methanol-fuelled boxship christened and named “Laura Maersk”

Photo credit: VPS

Published: 30 January, 2024

Business

Exclusive: Estimated marine fuel sales figures of Singapore top 10 bunker suppliers by volume in 2023

Top three gainers for 2023 were Sinopec Fuel Oil (+16), Pegasus Maritime (+12), and both Kenoil Marime Services (+6) and Central Star Marine Supplies (+6).

Published

4 months agoon

January 16, 2024By

Admin

The Maritime and Port Authority of Singapore (MPA) on Friday (12 January) updated its list of top bunker suppliers by volume in 2023.

A survey conducted by Singapore marine fuels publication Manifold Times with selected industry sources revealed the estimated annual bunker sales volume for the republic’s top 10 Singapore bunker suppliers in 2023:

| ESTIMATED ANNUAL FIGURES OF TOP 10 BUNKER SUPPLIERS BY VOLUME (YEAR 2023) | ||

| Position | BUNKER SUPPLIERS | Volume in 2023 |

| 1 | EQUATORIAL MARINE FUEL MANAGEMENT SERVICES PTE LTD | 5.0 million mt |

| 2 | TFG MARINE PTE LTD | 4.8 million mt |

| 3 | SINOPEC FUEL OIL (SINGAPORE) PTE. LTD. | 4.7 million mt |

| 4 | PETROCHINA INTERNATIONAL (S) PTE LTD | 4.6 million mt |

| 5 | VITOL BUNKERS (S) PTE. LTD. | Not available |

| 6 | CHEVRON SINGAPORE PTE LTD | Not available |

| 7 | BP SINGAPORE PTE. LIMITED | 2.94 million mt |

| 8 | GLOBAL ENERGY TRADING PTE LTD | 2.44 million mt |

| 9 | SHELL EASTERN TRADING (PTE) LTD | Not available |

| 10 | ENG HUA COMPANY (PTE) LTD | 2.2 million mt |

The top three gainers for 2023 were Sinopec Fuel Oil (Singapore) Pte. Ltd (+16) which entered the Singapore market in 2022, Pegasus Maritime (S) Pte Ltd (+12), and both Kenoil Marime Services Pte Ltd (+6) and Central Star Marine Supplies Pte Ltd (+6).

Fratelli Cosulich Bunkers (S) Pte Ltd dropped by ten places from 26th in 2022 to 36th position in 2023.

A total of 41 bunker suppliers was registered in this year’s list (compared to 42 in 2022) due to the departure of Toyota Tsusho Petroleum Pte Ltd in Q4 2023.

A list of all bunker suppliers ranked by volume in 2023 (versus position in 2022) and their movement are as follows (best viewed on desktop):

| LIST OF ALL BUNKER SUPPLIERS BY VOLUME (YEAR 2023) | |||

| Position in 2023 | BUNKER SUPPLIERS | Position in 2022 | Movement |

| 1 | EQUATORIAL MARINE FUEL MANAGEMENT SERVICES PTE LTD | 1 | 0 |

| 2 | TFG MARINE PTE LTD | 3 | +1 |

| 3 | SINOPEC FUEL OIL (SINGAPORE) PTE. LTD. | 19 | +16 |

| 4 | PETROCHINA INTERNATIONAL (S) PTE LTD | 2 | -2 |

| 5 | VITOL BUNKERS (S) PTE. LTD. | 4 | -1 |

| 6 | CHEVRON SINGAPORE PTE LTD | 8 | +2 |

| 7 | BP SINGAPORE PTE. LIMITED | 6 | -1 |

| 8 | GLOBAL ENERGY TRADING PTE LTD | 7 | -1 |

| 9 | SHELL EASTERN TRADING (PTE) LTD | 5 | -4 |

| 10 | ENG HUA COMPANY (PTE) LTD | 11 | +1 |

| 11 | GLENCORE SINGAPORE PTE.LTD. | 13 | +2 |

| 12 | MINERVA BUNKERING PTE LTD | 9 | -3 |

| 13 | MAERSK OIL TRADING SINGAPORE PTE LTD | 12 | -1 |

| 14 | EXXONMOBIL ASIA PACIFIC PTE LTD | 14 | 0 |

| 15 | SENTEK MARINE & TRADING PTE LTD | 10 | -5 |

| 16 | MARUBENI INT'L PETROLEUM (S) PTE LTD | 17 | +1 |

| 17 | GOLDEN ISLAND DIESEL OIL TRADING PTE LTD | 16 | -1 |

| 18 | SINGAMAS PETROLEUM TRADING PTE LTD | 23 | +5 |

| 19 | BUNKER HOUSE PETROLEUM PTE LTD | 24 | +5 |

| 20 | CATHAY MARINE FUEL OIL TRADING PTE LTD | 21 | -1 |

| 21 | HONG LAM FUELS PTE LTD | 15 | -6 |

| 22 | SK ENERGY INTERNATIONAL PTE LTD | 20 | -2 |

| 23 | CONSORT BUNKERS PTE LTD | 18 | -5 |

| 24 | TOTALENERGIES MARINE FUELS PTE LTD | 22 | -2 |

| 25 | KENOIL MARINE SERVICES PTE LTD | 31 | +6 |

| 26 | PEGASUS MARITIME (S) PTE LTD | 38 | +12 |

| 27 | PALMSTONE TANKERS & TRADING PTE LTD | 28 | +1 |

| 28 | GLOBAL MARINE TRANSPORTATION PTE LTD | 27 | -1 |

| 29 | TRITON BUNKERING SERVICES PTE LTD | 34 | -5 |

| 30 | SIRIUS MARINE PTE LTD | 30 | 0 |

| 31 | CENTRAL STAR MARINE SUPPLIES PTE LTD | 37 | +6 |

| 32 | GRANDEUR TRADING & SERVICES PTE LTD | 25 | -7 |

| 33 | CNC PETROLEUM PTE LTD | 32 | -1 |

| 34 | IMPEX MARINE (S) PTE LTD | 36 | +2 |

| 35 | HAI YIN MARINE PTE LTD | 39 | +4 |

| 36 | FRATELLI COSULICH BUNKERS (S) PTE LTD | 26 | -10 |

| 37 | VICTORY PTE LTD | 35 | -2 |

| 38 | EASTPOINT INTERNATIONAL MARKETING PTE LTD | 33 | -5 |

| 39 | HAI FU MARINE SERVICES PTE LTD | 40 | +1 |

| 40 | BUNKER B PTE LTD | 41 | +1 |

| 41 | SHELL SINGAPORE PTE. LTD. | 42 | -1 |

- Includes conventional bunker and biofuel bunker

This year saw MPA including a list of top biofuel bunker suppliers by volume in 2023 with several new entries recorded supplying biofuel at the world’s largest bunkering port; the data is as follows:

| LIST OF ALL BUNKER SUPPLIERS BY VOLUME OF BIOFUEL SUPPLIED (YEAR 2023) | ||

| Position in 2023 | BUNKER SUPPLIERS | Position in 2022 |

| 1 | MAERSK OIL TRADING SINGAPORE PTE LTD | New entry |

| 2 | CHEVRON SINGAPORE PTE LTD | 1 |

| 3 | BP SINGAPORE PTE. LIMITED | 3 |

| 4 | VITOL BUNKERS (S) PTE. LTD. | 2 |

| 5 | MINERVA BUNKERING PTE LTD | 6 |

| 6 | TOTALENERGIES MARINE FUELS PTE LTD | 4 |

| 7 | SHELL EASTERN TRADING (PTE) LTD | New entry |

| 8 | TFG MARINE PTE LTD | New entry |

| 9 | EXXONMOBIL ASIA PACIFIC PTE LTD | 5 |

| 10 | CATHAY MARINE FUEL OIL TRADING PTE LTD | New entry |

| 11 | GLOBAL ENERGY TRADING PTE LTD | 8 |

| 12 | GOLDEN ISLAND DIESEL OIL TRADING PTE LTD | New entry |

| 13 | PETROCHINA INTERNATIONAL (S) PTE LTD | New entry |

| 14 | KENOIL MARINE SERVICES PTE LTD | 9 |

Manifold Times recently reported a total of 51.82 million tonnes of bunker sales being registered in 2023, surpassing the previous record of 50.64 million tonnes in 2017.

Related: Singapore achieves milestone with record year for bunker sales in 2023

Related: Toyota Tsusho Petroleum removed from licensed bunker suppliers list in Port of Singapore

Related: Exclusive: Estimated marine fuel sales figures of Singapore top 10 bunker suppliers by volume in 2022

Related: Exclusive: Estimated marine fuel sales figures of Singapore top 10 bunker suppliers by volume in 2021

Related: Exclusive: Singapore top bunker suppliers reveal estimated sales volume for 2020

Related: Exclusive: Singapore top bunker suppliers reveal estimated sales volume for 2019

Related: Exclusive: Estimated annual sales volume for Singapore top bunker suppliers (2018)

Related: Exclusive: Singapore top bunker suppliers reveal monthly sales volume (2017)

Photo credit: Manifold Times

Published: 16 January 2024

Banle Energy enters Mauritius market, marking first foray into African continent

Japan: NS United orders methanol-powered bulk carriers

Clyde & Co on legal issues pertaining to bio bunker fuels in international shipping

Specs Corporation to be official Auramarine sales rep for fuel supply units in South Korea

Global Maritime Forum: Will greenwashing claims target green corridors next?

Chris Chatterton announces his departure from Methanol Institute

ENGINE: Europe & Africa Bunker Fuel Availability Outlook (15 May 2024)

TFG Marine completes first bunker fuel delivery with “Margherita Cosulich” barge

Fratelli Cosulich methanol, biofuel bunker barge en route to Singapore

PetroChina completes its first bonded bunkering operation in Hainan

Walvis Bay green hydrogen production plant to include ammonia bunkering

Bunker One accuses rival of unfair competition with Russian oil

Vopak and Singapore Polytechnic team up in safety training on low carbon bunker fuels

Circtec and bp ink agreements to advance renewable tyre-derived bunker fuel

Trending

-

Bunker Fuel2 weeks ago

Bunker Fuel2 weeks agoTFG Marine completes first bunker fuel delivery with “Margherita Cosulich” barge

-

Alternative Fuels1 week ago

Alternative Fuels1 week agoFratelli Cosulich methanol, biofuel bunker barge en route to Singapore

-

Bunker Fuel2 weeks ago

Bunker Fuel2 weeks agoPetroChina completes its first bonded bunkering operation in Hainan

-

Alternative Fuels1 week ago

Alternative Fuels1 week agoWalvis Bay green hydrogen production plant to include ammonia bunkering

-

Business1 week ago

Business1 week agoBunker One accuses rival of unfair competition with Russian oil

-

Alternative Fuels1 week ago

Alternative Fuels1 week agoVopak and Singapore Polytechnic team up in safety training on low carbon bunker fuels

-

Bunker Fuel2 weeks ago

Bunker Fuel2 weeks agoCirctec and bp ink agreements to advance renewable tyre-derived bunker fuel

-

Biofuel2 weeks ago

Biofuel2 weeks agoHolland America Line begins long-term bio bunker fuel test on “Rotterdam” cruise ship